Fixed Income Investments serve to diversify your portfolio, help to stabilize your overall return, and create a predictable income stream to support your desired lifestyle.

Bonds can provide excellent Risk-adjusted returns. Let’s evaluate where we should invest in the current market scenario.

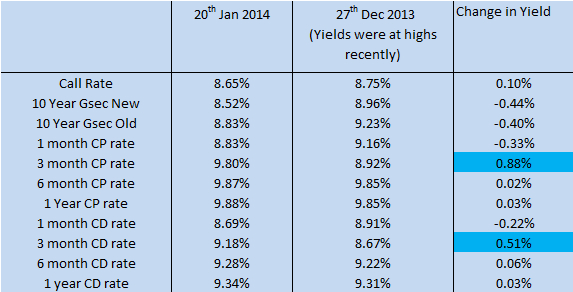

- The 10 year G-sec Yield has cooled off to 8.52% after moving above 9% last month.

- Largely led by primary articles, Inflation at both wholesale and consumer levels have shown a large down-tick.

- On Account of fall in food inflation the Retail inflation dropped to 9.87% in December.

- WPI fell to 6.16% the lowest level of Inflation in last 5 months.

- The fall in inflation is in line with RBI expectations.

- For the month of January the inflation number may come even softer driven by further cut in agri inflation and base effect.

- The Inflation data coupled with weak demand and possible fiscal cuts may signal a plateau for interest rates.Please go through the movement of Yields in last few days.

Please go through the movement of Yields in the last few days.

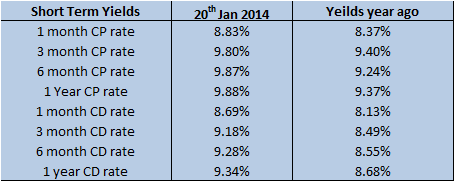

Comparison of Short Term Yields Y-O-Y

The above tables clearly depict that the opportunity lies at the shorter end of the curve and the yields at the shorter end of the curve have started hardening. The last quarter of the fiscal has always been a period where liquidity is sparse.

Investors should gradually take exposure in Short Term Income Funds to benefit from high yields due to the seasonal liquidity crunch in February and March. AMC’s look to capture the spike in yields and build/restructure the portfolio in Mid-Feb to get the maximum benefit of the yields.

Yields on the short-term papers have already started hardening and one can expect good accrual income from the funds. The short-term income funds gain from good accrual income as well as capital gains when the liquidity eases post-march.

Recommended Funds:

Ultra Short Term Funds (For time horizon 3 to 6 months) – ICICI Prudential Ultra Short Term Fund, Reliance Money Manager Fund, Sundaram Ultra Short Term Fund, Birla SL Floating rate fund – Long Term Plan

Short Term Income Funds (For Time horizon 6 months to 1 year ) – ICICI Pru Short Term Plan, Sundaram Select Debt – Short Term Plan, Axis Short Term Plan, IDFC SSI Short Term Fund. Short Term funds have an exit load so please check the same before investing.