Any moving object has Momentum and so is its relevance to our moving stock prices. Momentum Investing has been a popular strategy and is termed as “The premier anomaly” by Eugene Fama, the father of the Efficient Market Hypothesis

Momentum is a popular factor worldwide and easy to understand. Investors use Momentum Investing to make a profit from the herd behavior of the market participants. The strategy followed here is a “Buy high: sell higher” rather than the traditional “Buy low: sell high”

Momentum investors chase performance, they try to achieve alpha by investing in a stock that is trending upwards and by shorting/selling stocks that are trending downwards.

Key Takeaways

- What is Momentum Investing and How is it different ?

- Know about Momentum Indices

- Should you Invest ?

What is momentum Investing and how it is different

Understanding Momentum

Momentum is a physics term that defines the quantity of motion an object has. In the context of Investing when you see the rate of change in the underlying instrument is more we say it’s in a good momentum and vice-versa for low momentum.

Traders in the equity markets use momentum to a large extent while identifying the stock to invest in. Momentum can be used in both ways for an upward as well as a downward trend.

How momentum factor works in the Stock market

Study after study has shown momentum investing typically is a market-beating strategy and does challenge the efficient market hypothesis.

There is no clear answer to why the momentum factor works in the stock markets. As per studies, the strategy’s success can be attributed to behavioral aspects of investors – Investors either overreact to important information or under-react to it. Investors also tend to react instantly to the news which confirms their beliefs and underreact to the news that dis-confirms.

Some investors tend to react gradually to news or development in a stock. For e.g, good quarterly results declared by a corporate may get the instant effect or the revision of expectations upwards may take some time. Once the good performance is reflected in stock price more investors herd up and increase the exposure which leads to further price rise.

The Difference

Momentum Investment is typically based on trends, so broadly the fundamentals of the stock or the broad economy do not come into the picture. Fundamentals are the foundation of Investment and need a lot of hard work whereas Momentum investing exploits the irrationality of market players.

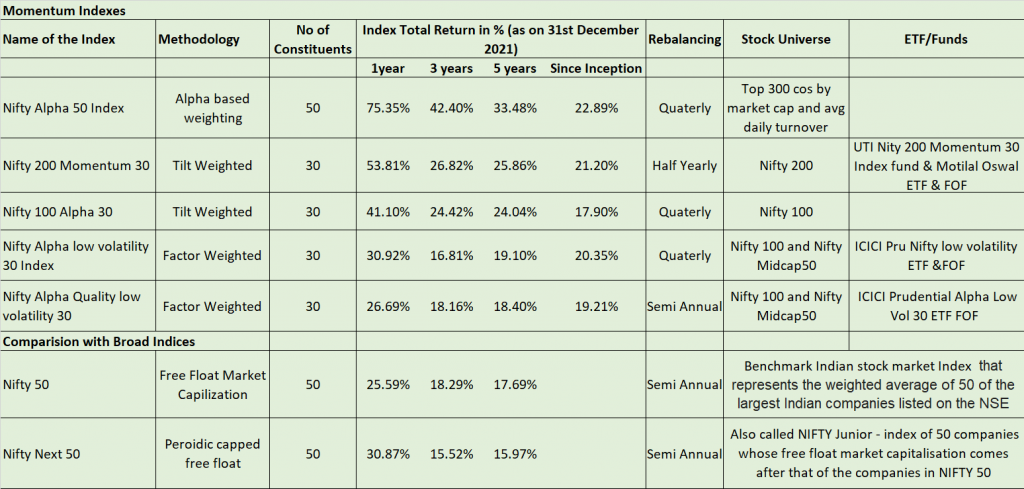

Indices based on Momentum

If you are a new investor and would like to try momentum investing you should go the passive way first. Below is the list of various Indices which are based on momentum. More details on them can be accessed here.

Should you Invest?

Before investing you should know that Momentum Investing may be simple but not easy. Secondly, it is a high cost, high turnover strategy. When the flow is good one feels good to move with momentum, but it may reverse and may be painful for the investor.

Nevertheless, looking at its proven success, one can invest a part of the portfolio in the momentum basket.

The success of the strategy thrives as Humans are not perfectly rational, and nor is human psychology set to change in near future. Would you like to move with the swing ??

Let me know your thoughts in the comments..