Invesco India Mutual fund launches a Fund of Fund offer for Invesco India Global Consumer Trends.

The Fund will invest in Invesco Global Consumer Trends fund, a Luxembourg domiciled Invesco Fund, which invests in a global portfolio of equities focussed on discretionary consumer needs of Individuals.

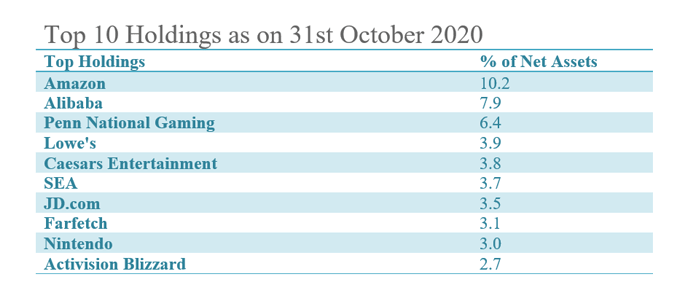

The underlying fund offers the investors exposure to global companies that may benefit from changing consumer trends, over the long term. The fund has invested currently in a wide range of investment themes like e-commerce, entertainment, internet services, autonomous driving to active lifestyles.

The fund managers follow a continuous process of identifying companies with high-quality earnings growth and potential for favorable capital appreciation by gaining a share in discretionary demand.

Do read my earlier article on why you should invest in a global fund here.

Let’s understand and review the underlying fund: Invesco Global Consumer Trends fund

AUM: USD 2.76 Billion – INR 20,416.60 Crores.

Benchmark: MSCI World Consumer Discretionary Index – Net Dividend

Fund Domiciled: Luxembourg

Portfolio Managers – Ido Cohen (Lead PM since May 2011) & Juan Hartsfield, CFA, January 2009

Other Highlights:

- Flexible approach – The fund is Flexible with a concentration towards companies that are expected to profit from changing consumer discretionary trends: currently eCommerce, digital media consumption, demographic shifts towards experiences over material goods or towards healthier lifestyles, and global consumer durable and non-durable goods cycles.

- Rigorous investment approach – The team’s investment approach is a bottom-up, research-driven process that enables them to narrow the field of stocks to identify those companies best able to capitalize on key themes driving consumer spending.

- Experienced team – The fund managers of the underlying fund, Ido Cohen (lead) and Juan Hartsfield offer clients an average of 22 years’ fund management

Performance of the fund

In USD Terms

| Period | Fund C – ACC Shares | Benchmark |

| 1 year | 35.18% | 19.35% |

| 3 years | 14.88% | 13.04% |

| 5 years | 16.12% | 12.05% |

| 10 years | 16.51% | 12.83% |

| Since Inception | 9.57% | 6.49% |

Performance in INR

| Period | Fund C – ACC Shares | Benchmark |

| 1 year | 41.23% | 24.70% |

| 3 years | 20.16% | 18.23% |

| 5 years | 19.08% | 13.89% |

| 10 years | 22.62% | 18.75% |

| Since Inception | 12.37% | 9.21% |

Recommendation

Should you invest in the NFO ?

Investing Globally not only provides you the much-needed access to the business which are truly global but also adds diversification that’s necessary to build a healthy investment portfolio. The fund gives you the access to invest in successful companies which are at the forefront of the changing consumer trends.

The fund remains dominated by digital lifestyle themes, which currently represent majority of the portfolio.

Everything is changing during the tough Covid times, i.e. the way we shop, travel, consume entertainment, and connecting with the world through social media…

What we are witnessing is a generational shift in consumer behaviors and most of these trends are here to stay.

We Recommend Investment in the Fund for the long term and benefit from consumer trends driven by changes in standards of living, demographics, connectivity, and digital lifestyle.