ICICI Prudential AMC has recently launched a new feature in the Systematic Transfer Plan (STP) option. STPs are used by investors to transfer a fixed sum of the amount at regular intervals from source schemes to Target Schemes.

STPs are commonly used by investors who don’t want to invest in lump sum as they are not confident about the valuations of the markets. They prefer investing fixed sums at regular intervals to benefit from the rupee cost averaging. For E,g instead of investing Lumpsum amount in an Equity fund, an investor can park the funds in liquid/ultra short-term fund and instruct the AMC by STP form to transfer equal amounts in 10 installments to equity fund at regular intervals.

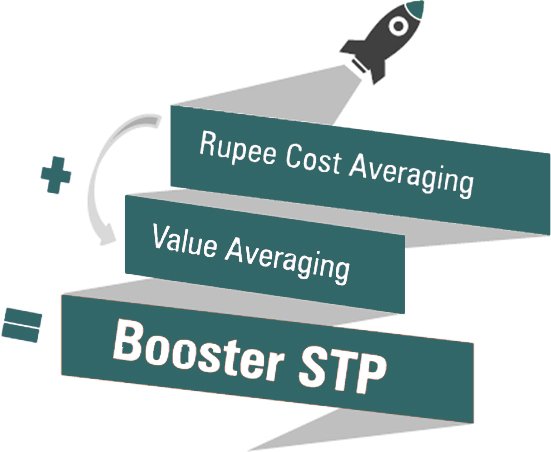

What is booster STP and how will it be useful?

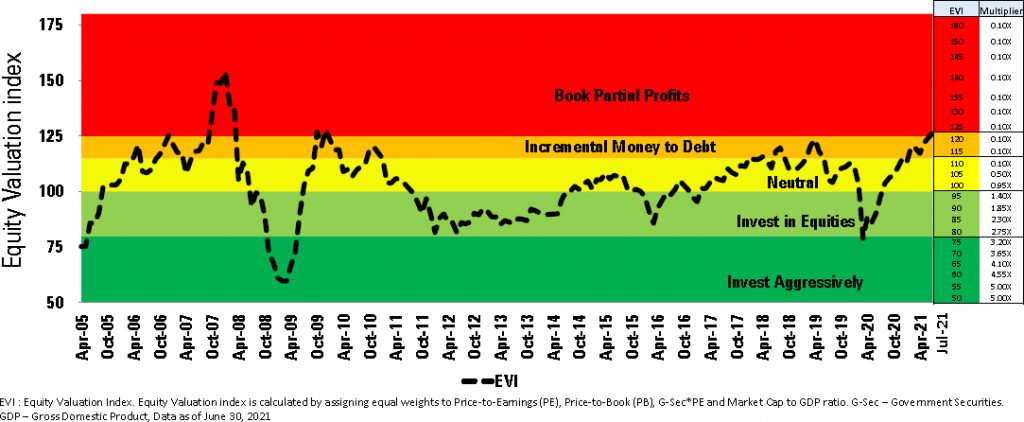

- The Power to Invest variable amount – The booster STP will invest a variable amount in the range of 0.1x – 5x of the base STP amount depending on market scenarios. Say your base STP is Rs 10,000 – When markets are attractive the STP can go upto 5x i.e Rs. 50,000 or when the markets are over-valued the STP amount can be 0.1x that is as low as Rs. 1000.

- The Power of Variable tenure – The booster stp will divide the Investment corpus such as the market opportunities can be tapped efficeintly. For E.g if the markets are expesive the tenure could be 38 months, and when they are attractive it could be 3 months. The AMC has backtested the Option and average STP tenure as per STP booster was 16 months.

Booster STP

A Combination of Value Averaging Plus Rupee Cost Averaging strategy

- Booster STP staggers the investment by dynamic installment & dynamic tenure

- Solution for those with lump-sum money to invest and looking for an optimal investment strategy to invest in for the long term.

- Modifies Investment amount based on market valuation.

- The Allocation made on the basis of In-house valuation parameter Equity Valuation Index EVI

- EVI : The equity Valuation index is calculated by assigning equal weights to Price-to-Earnings (PE), Price-to-Book (PB), G-Sec*PE and Market Cap to GDP ratio.

The EVI and STP Instalments

The multiplier of the STP amount is decided based on the Equity Valuation Index. Currently, the EVI value is 124 as per the model.

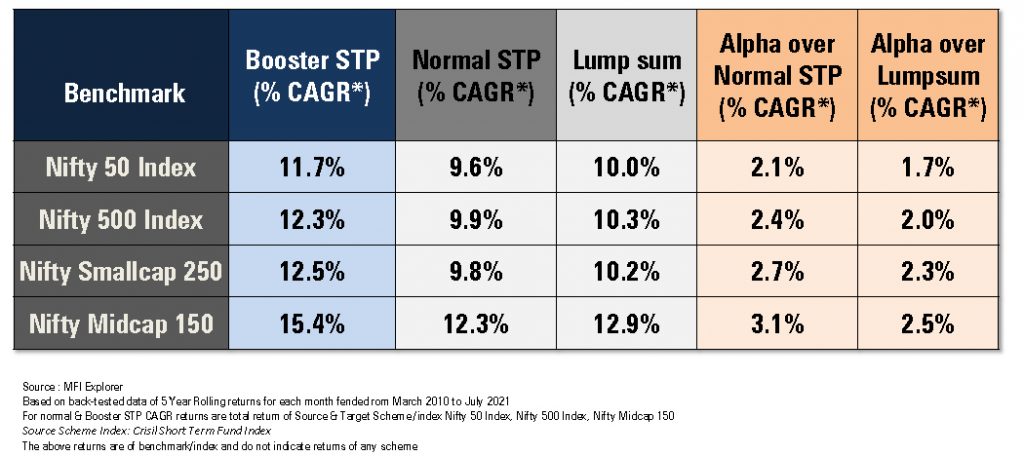

Past Performace – Strategy can be a potential Alpa Generator

The AMC has tested the strategy for various time periods and at different market scenarios. The detailed calculations can be found on the AMCs website https://www.icicipruamc.com/

Below is a table that gives you an idea of the alpha generated by the Booster STP over the normal STP for backtesting done on data of 5 years rolling returns for each month from March 2010 to July 2021.

Conclusion

Booster STP is a new solution for the Indian MF investor which will prove helpful as well as rewarding. The Investors who are nowadays looking for options for timing the market will find a solution that will not involve any emotional stress.

The strategy is introduced by ICICI Pru AMC and we are looking forward to such solution-oriented products from other AMCs also.