It is desirable to have No Debt altogether, but in realistic terms, it’s not possible.

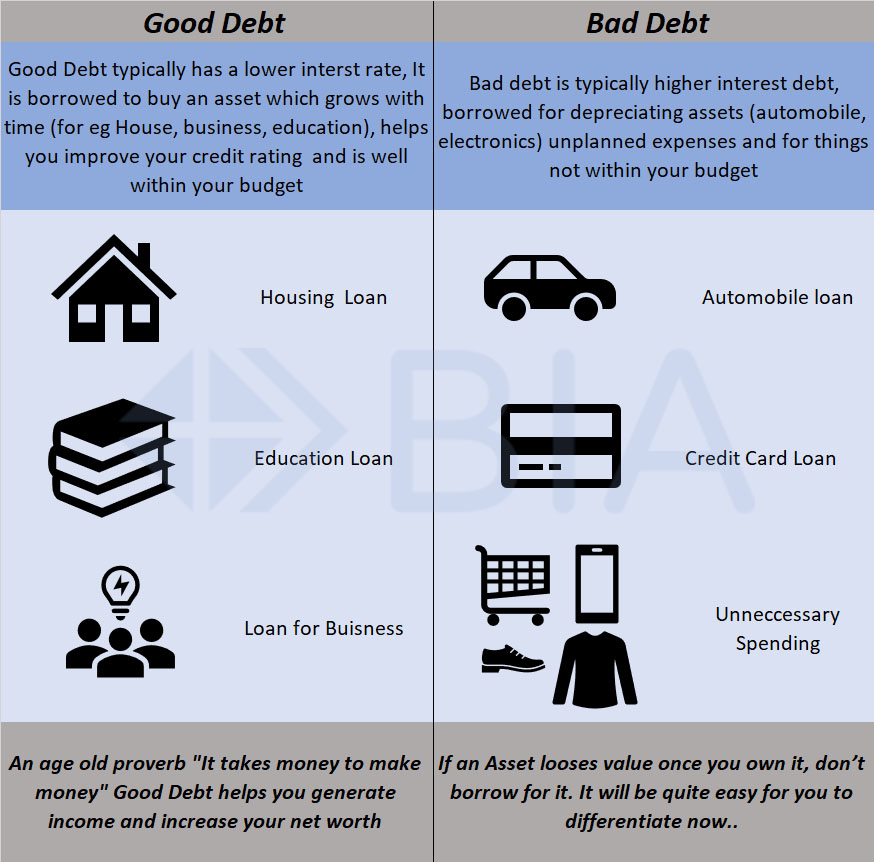

Debt is what we take today and pay off sometime in the future with interest. Debt can have positive or negative consequences on your finances, so typically you should know which one is good debt and which one is bad debt.

A Simple rule to understand is if the debt increases your net worth or has future value it’s good debt. Borrowing for the purchase of a house is an example of good debt.

Debt to Income Ratio DTI

The debt to Income ratio is a parameter that is kept in mind by banks & financial institutions before approval of loans. The Loan eligibility is determined on this parameter. The higher the ratio the lower your chances to get a fresh loan.

The Debt to income ratio is calculated as follows

DTI = (Net Debt Payments / Net Income )*100

In India, a DTI ratio of 40% is the highest that a borrower can have and still have a fresh loan.

Good debt allows you to leverage your wealth & helps you in managing your finances effectively. Ideally, one should have a debt to income ratio between 21-35% as a low DTI ratio indicates a good balance in your finances.

Do share your views and feedback in the comments section