Give your Portfolio the Stability & Growth

Are you building your Mutual fund portfolio for the first time or afresh? Not sure where to invest .. start with Bluechip/ Large Cap funds

Equity is a powerful asset class that offers potential for long-term wealth generation. An investor who maintains a diligent and disciplined approach realizes the potential in his wealth accumulation journey.

Large Cap Equity Mutual Funds make a base for your equity portfolio and should weigh at least 35-40% of your equity portfolio.

Why Invest in Bluechips / Large Cap

- Bluechip companies are recognised, have a larger market cap & survived various business cycles

- Bluechip stocks are relatively safer & less volatile

- Help in achieving Long Term Capital Appreciation and give stability to the portfolio

Bluechip

The term was first used in 1923, by Oliver Gingold a DowJones Employee who observed certain stocks quoting more than $200.

It originates straight from the color of high-value chips found at the Poker table. Poker Players bet in Blue, white and red chips. Blue Chips have the highest value.

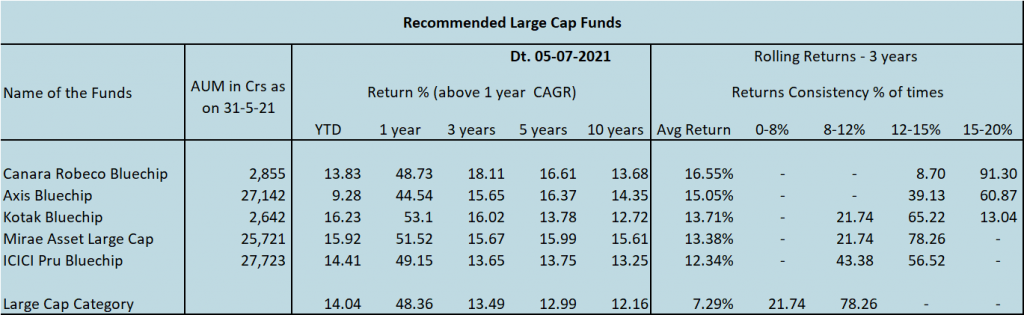

BIA Capital Recommends following Large Cap Funds for your Mutual Fund Portfolio.

A brief rationale for selecting the above funds :

A. Canara Robeco Bluechip – The fund was launched in August 2010 and has generated a return of 13.07% since its launch. Having a portfolio of 48 stocks, the top 10 stocks constitute 50.67% of its portfolio, the concentrated bets of the fund have given good returns. The Portfolio is predominantly growth-oriented. The Fund has done exceptionally well on the parameters of the Rolling returns. The Fund has generated between 15-20% p.a. – 91% of the time in a three-year rolling period.

B. Axis Bluechip Fund – One of the most popular funds in the segment was launched in Jan-2010 and has generated a return of 13.28% since its launch. The fund has invested in 36 stocks and has a highly concentrated portfolio, with the top ten accounting for the 67% of the portfolio. The Fund has been a consistent performer and a must-have in your portfolio

C. Kotak Bluechip Fund – The fund was launched in August 1998, previously known as the Kotak 50 fund. The fund has generated a whopping 18.55% since launch. The portfolio constitutes 53 stocks predominantly growth-oriented. Despite the exceptional performance, the fund’s AUM is negligible shows the investors are unaware of the hidden gem. The fund has also scored well on the rolling returns parameter.

D. Mirae Asset Large Cap Fund – The Fund has been the top-performing in the category for the period of 7 & 10 years. Launched in April-2008 the fund has generated 16% since inception. The fund has a portfolio of 58 stocks and the top 10 picks account for 56% of the portfolio.

E. ICICI Prudential Bluechip Fund – The Most loved fund in the category, and the fund which never disappoints. The fund follows the Nifty 50 Index and has an index-hugging strategy. The fund was launched in May 2008 and generated 14.32% since its launch. The Fund is a must-have for a conservative investor.

Bluechips are used to build the core of the portfolio and generally shouldn’t be the entire portfolio. Will cover the recommended Flexi Cap Funds in the next article.

Do share your views and feedback in the comments section.