Equity is a powerful asset class that offers potential for long-term wealth generation. However, this potential is only realized for those investors that are able to maintain a diligent and disciplined approach towards it. The Investors should also select the schemes wisely wherein the fund managers are aligned in their long-term approach to risk management and wealth creation.

Large Cap Equity Mutual Funds make a base for your equity portfolio and should weigh at least 35-40% of your equity portfolio.

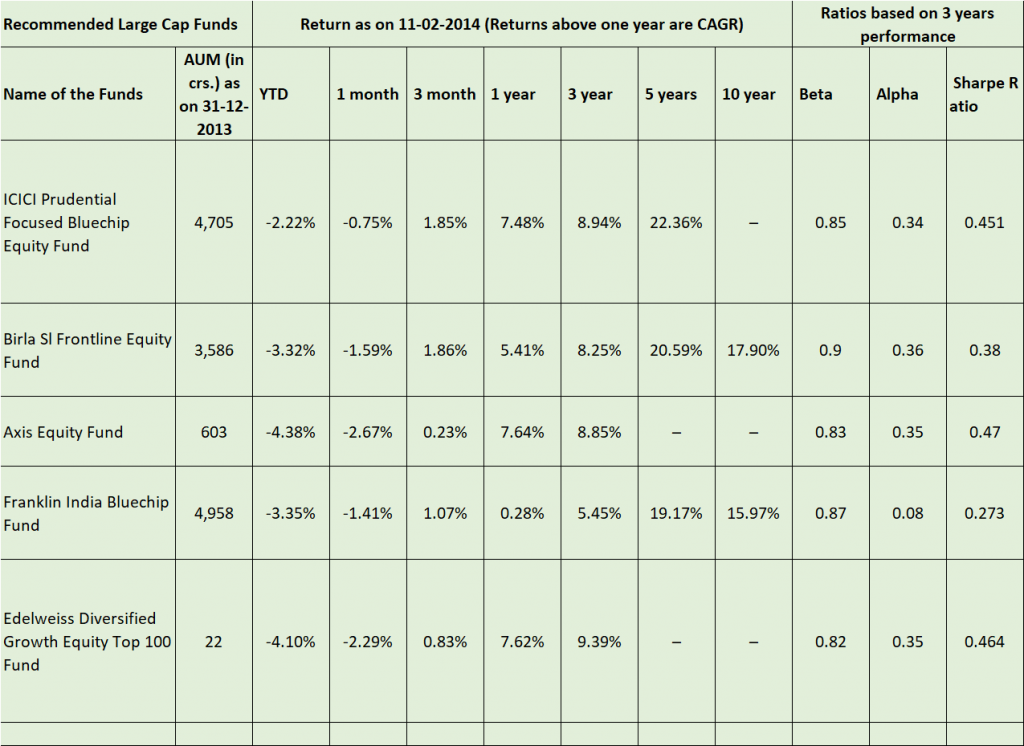

BIA Capital Recommends following Large Cap Funds for your Mutual Fund Portfolio.

A brief note on the recommended funds :

1. ICICI Prudential Focused Bluechip Equity Fund.

- ICICI Prudential Focused Blue chip Equity Fund is an Open-ended equity scheme that aims for growth from a focused and optimally diversified portfolio. It invests in equity and equity related securities of about 30 – 35 companies belonging to the large cap domain and Large cap stocks generally recover faster than small-cap and mid cap stocks

- This fund adopts a bottom-up approach while selecting stocks without any sectoral biases

- The Fund has a Sharpe ratio of 0.452, signifying a better risk-adjusted performance

- Though the fund has only been in existence for a little over five years, it has consistently managed to deliver returns higher than its benchmark.

- The Top 5 holdings include HDFC Bank (8.14%), Infosys (7.37%), ICICI Bank (6.64%), ITC (6.86%) & Kotak Mahindra (4.36%) as on 31st Jan 2014.

2.. Birla Sun Life Frontline Equity Fund

- The fund invests predominantly in the large cap companies with a small exposure to small cap. The fund maintains the same sectoral weights as BSE 200 hence performance deviation with the benchmark is lower and has a diversified portfolio.

- In its December -13 portfolio, the fund held 68 stocks.

- The fund manager selects the scrips which offer better growth opportunities in the front line stocks.

- Top 5 Sectors in the fund are Banking & Finance (23.39%), Technology (13.76%), Automotive (8.75%), Engineering (8.43%) & Pharmaceuticals (7.71%)

3. Axis Equity Fund

- The fund which endeavors to maintain volatility lower than the benchmark while outperforming the benchmark returns.

- The fund was launched in January 2010 and been in the Top quartile performers.

- The Fund invests in companies having strong growth, with 85% exposure to large cap stocks.

4. Franklin India Bluechip Fund

- The fund focuses investing in large-cap companies with strong financials, quality management and market leadership

- Investors looking for steady and consistent large-cap performers can buy Franklin India Blue chip

- It has completed nearly 20 years and is one of the oldest, with a proven track record. The fund has generated a return of 22.51% p.a. since inception and 24.44% p.a.in last 15 years

- The fund has a major exposure to Banking, software and pharma segment

5. Edelweiss Diversified Growth Equity Top 10 Fund

- The Fund is a Large cap Fund driven by the Quant Model. Quant is a very successful and widely accepted method of stock selection worldwide.

- Quant – it is basically a system that has predefined parameters to buy & sell stocks. The parameters may be many – sector, market cap, earning potential, price sensitivity and other factors. This reduces the risk of human error.

- Any scrip which does not perform for 2 quarters is exited from the portfolio, thus the portfolio runs with performers only.

- The fund may also participate in derivatives to add on to returns or serve as a hedge.