Today’s article reminds of the following quote :

The First step is always the hardest, but it’s the only way to reach the second step. – Susan Gale

Being a Millionaire, a multi-millionaire, or in the Indian Context being a Crorepati is always desirable. It is achievable too if you have a disciplined savings approach.

Let’s analyse how one can achieve this wealth accumulation goal. As we know The First Step is always the hardest – Accumulating the First Crore is the hardest but later on your savings have a multiplying effect.

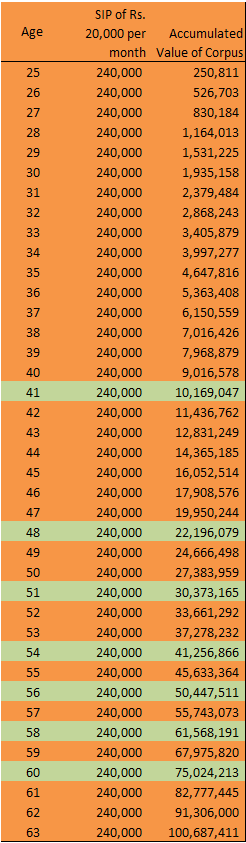

I have assumed in the calculation an investor aged 25 years saves Rs.20,000 per month and invests in a Mutual Fund SIP which gives him a return of 10% p.a.

You can see the Investor accumulates Rs One Crore at the age 41 years – it takes him 16+ years to achieve his target. The second crore he achieves in 7 years, the next one he gets in 3 years, the next in three years.. the time in which he accumulates an additional crore reduces with time.. isn’t it..

You must have heard “The first million is the hardest” – in fact, we believe it is equally difficult to accumulate the first 10,000 or the first 1,00,000. As you take steps towards accumulating or rather saving and investing money in a good income yielding asset class your journey becomes easier.

An increase from 1 crore to 2 crores is an increase of 100%, the increase from 2 crores to 3 crores is an increase of 50%, and from 3 crores to 4 crores the increase is only 33.34% likely from 9 crores to 10 crores the increase is only 11.1%…

“Accumulating the first $100,000 from a standing start, with no seed money, is the most difficult part of building wealth. Making the first million was the next big hurdle. To do that a person must consistently underspend his income. Getting wealthy is like rolling a snowball. It helps to start on the top of a long hill – start early and try to roll that snowball for a very long time. It helps to live a long life.” – Billionaire Charlie Munger

The Path is now clear for you and you need to take firm steps, the making of First Crore may not be simple but if you discipline yourself and save more and more every year you may reach the destination earlier and multiply your wealth from thereon..